Why use Request to Pay?

Request to Pay offers a range of benefits for organisations of all types and sizes. The innovative messaging framework allows billers to provide their customers with greater flexibility, control, and a quicker and easier way to communicate, in turn helping to save time and reduce worry. To put it simply, an improved customer experience, and that can only be win-win.

But that’s not all. Request to Pay can help organisations save in reconciliation fees and invoicing costs, while also helping to reduce failed payments. In addition, it can help finance teams more easily track payments and provide certainty of cashflow.

Importantly, not-for-profit organisations can also greatly benefit from Request to Pay, whether it be an improved level of engagement with donors or boosting retention rates. The flexibility the service offers allows supporters to defer, or skip a payment without cancelling altogether, while reducing the admin burden for finance teams.

Find out more about how Request to Pay could benefit your organisation, below.

Want to find out how you can benefit from Request to Pay? Speak to your bank today and ask them for more information.

Small business

Request to Pay will help you offer flexibility to your customers and easily track your finances.

What

Wasting time chasing vendors

How

Communicate through Request to Pay and monitor the payment status in real time

Why

Complete transparency for both sides. Enables a dialogue

What

It’s hard to plan ahead with an irregular income

How

Get paid quicker. No more paper slips and knocking on doors

Why

See who’s paid, instantly. Keep track of what’s owed to you

Large business

Use Request to Pay to bill customers and save on reconciliation fees, invoicing and avoid bounced payments.

What

Reconciliation is costly and inefficient

How

Each request and related payments contain a customer reference

Why

Save time, money and resources with easy reconciliation

What

No dialogue with customers until something goes wrong

How

Customers can ask for more time or for help with paying

Why

Work together and resolve issues, or extend the due date

Not for profit

Improve engagement with your donors, and increase retention rates.

What

Donors have no flexibility for recurring payments

How

Donors can skip a month, or pay less, but maintain the relationship for the future

Why

Cash-like flexibility month by month. Keep connected to your donors

What

Donations can take months to process

How

Offer instant payment methods to your donors

Why

Reduce donation processing from months to minutes

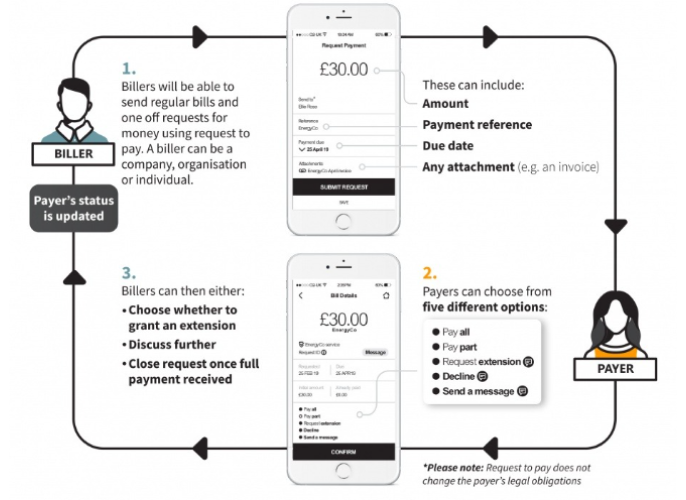

Request to Pay offers a range of benefits for organisations and, better still, the process behind it is simple, efficient, and straightforward. Check out the infographic which provides more information on how you can harness the many benefits of the service.

Want to find out how you can benefit from Request to Pay? Speak to your bank today and ask them for more information.

Case studies

Request to Pay fact sheet | Goverment and housing

Request to Pay fact sheet | Retail

Request to Pay fact sheet | Charities

Request to Pay fact sheet | Utilities

Request to Pay offers a range of benefits for organisations of all types and sizes. The innovative messaging framework allows billers to provide customers greater flexibility, control, and a quicker and easier way to communicate, in turn helping to save time and reduce worry. To put it simply, an improved customer experience and that can only be win-win.

But that’s not all, Request to Pay can help organisations save in reconciliation fees and invoicing costs, while also helping to avoid failed payments. In addition, it can help finance teams more easily track payments, in turn reducing admin.

The simple answer is that most type of bill could be managed easily and efficiently with Request to Pay. This includes regular utility bills, charitable donations, retail payments, and even payments between individuals.

Here’s the technical bit. Request to Pay is a secure messaging framework which stores the details of both billers and payers within its network. The network is made up of secure repositories, which store requests and route them between billers and payers, similar to the way email servers works. The biller and payer details are verified every time a request is made to ensure that they are genuine and help prevent fraud.

Speak to your bank today and ask about Request to Pay.

No, Request to Pay does not alter any legal rights and or obligations between a customer/supplier or a biller/payer in anyway including payment terms.